The Dollar As A Safe Haven Asset

Bringing together all these considerations, in the face of a variable and volatile global economic situation, U.S. real estate is returning to its role as a safe haven asset, able to protect investors and their families and guarantee returns.Table of Contents

- Is real estate a safe asset?

- What are the safe haven assets?

- What is the best safe haven asset?

- Which is considered as a safe haven asset class?

- Investors turn to real estate as a safe haven

- What are considered haven assets?

- Is cash a safe haven asset?

- Is real estate the safest investment?

- What is the #1 safest investment?

- What is the safest investment?

- What are safe havens for investors?

- What is the riskiest asset class?

- What are the most valuable assets in a time of crisis?

- Why real estate is not a good investment?

- Is real estate safer than stocks?

- Why real estate is safest investment?

- Is real estate the best investment?

- Where's the safest place to put your money?

- What is the safest investment 2022?

- Why is everyone investing in real estate?

- Is real estate better than stocks?

- Is real estate the best way to build wealth?

- Are bonds a safe haven?

- What does my safe haven mean?

Is real estate a safe asset?

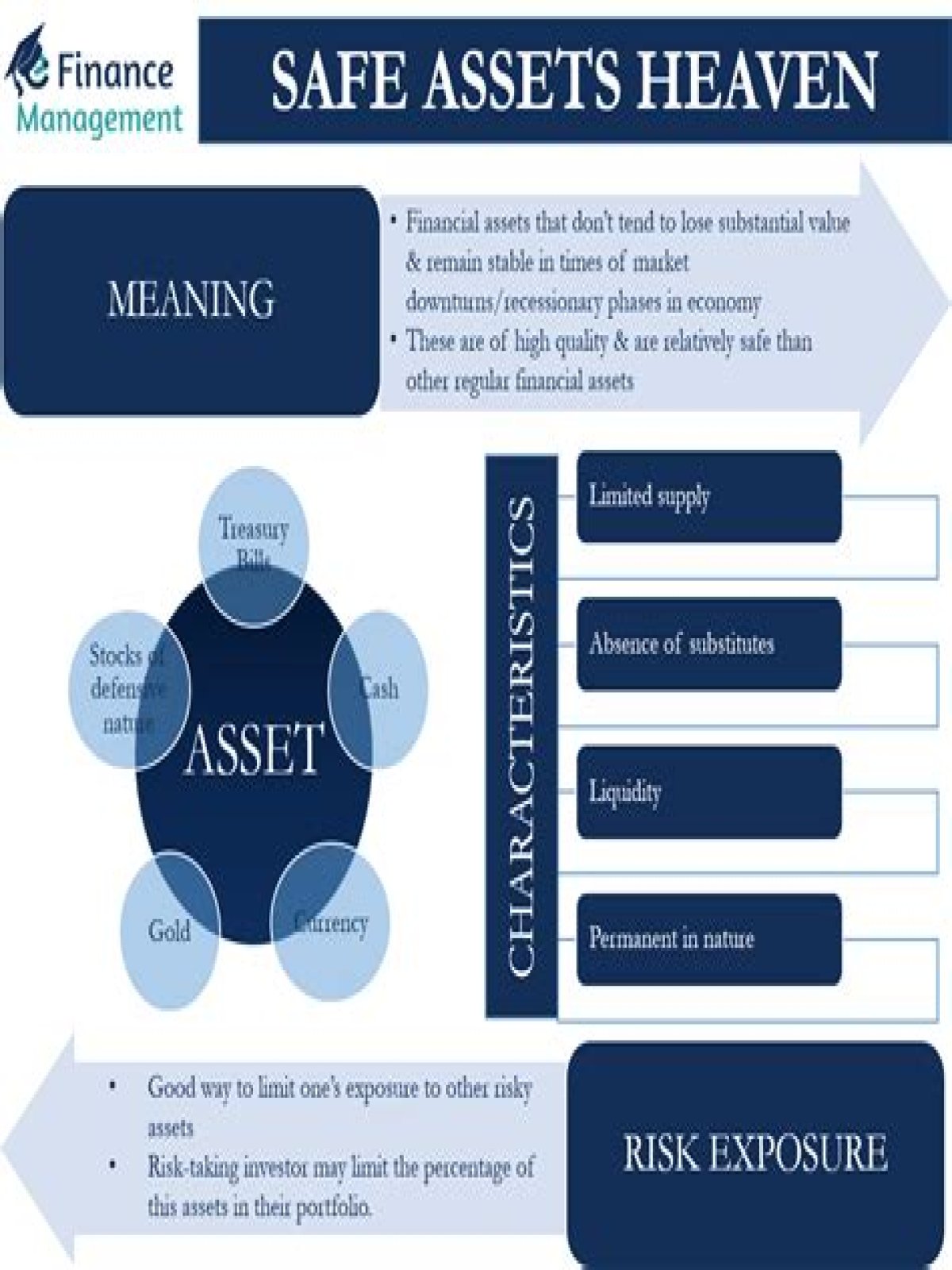

Safe assets are assets which, in and of themselves, do not carry a high risk of loss across all types of market cycles. Some of the most common types of safe assets historically include real estate property, cash, Treasury bills, money market funds, and U.S. Treasuries mutual funds.What are the safe haven assets?

There are a number of investment securities that are considered to be safe havens.

- Gold. For years, gold has been considered a store of value. ...

- Treasury Bills (T-Bills) ...

- Defensive Stocks. ...

- Cash. ...

- Currencies.

What is the best safe haven asset?

Common Safe-Haven Investments

- Precious Metals. Precious metals are one of the most popular safe havens on the market today. ...

- Utilities Stocks. ...

- Treasury ETFs. ...

- Treasury Bonds. ...

- Cash.

Which is considered as a safe haven asset class?

A safe-haven asset is a financial instrument that is expected to retain, or even gain value during periods of economic downturn. These assets are uncorrelated or negatively correlated with the economy as a whole, which means that they could appreciate in the event of a market crash.Investors turn to real estate as a safe haven

What are considered haven assets?

A safe-haven asset is a financial instrument that is expected to retain, or even gain value during periods of economic downturn. These assets are uncorrelated or negatively correlated with the economy as a whole, which means that they could appreciate in the event of a market crash.Is cash a safe haven asset?

For over 50 years, the US dollar has been one of the most popular safe-havens during economic downturns. It exhibits a number of safe-haven characteristics – most crucially, it is the most liquid currency on the forex market.Is real estate the safest investment?

1. It's one of the safest investments you can make. Real estate investing is safe and secured by the asset itself — the building. Rarely will you see your investment lose value and if so, it's usually only for a short period of time.What is the #1 safest investment?

Overview: Best low-risk investments in 2022

- High-yield savings accounts. ...

- Series I savings bonds. ...

- Short-term certificates of deposit. ...

- Money market funds. ...

- Treasury bills, notes, bonds and TIPS. ...

- Corporate bonds. ...

- Dividend-paying stocks. ...

- Preferred stocks.

What is the safest investment?

U.S. Treasury bonds are widely considered the safest investments on earth. Because the United States government has never defaulted on its debt, investors see U.S. Treasuries as highly secure investment vehicles.What are safe havens for investors?

Safe havens are investments that typically retain value or even increase in value when other investments lose ground. Bonds are a classic example of a safe haven asset. High-quality bonds with a low risk of default continue to pay interest through good times and bad.What is the riskiest asset class?

Equities are generally considered the riskiest class of assets. Dividends aside, they offer no guarantees, and investors' money is subject to the successes and failures of private businesses in a fiercely competitive marketplace. Equity investing involves buying stock in a private company or group of companies.What are the most valuable assets in a time of crisis?

That's what some people call it. “The most valuable asset in a time of crisis”. Or even: “The world's most valuable asset in a time of crisis”. And, of course, they're talking about gold.Why real estate is not a good investment?

Income isn't guaranteedA popular reason we hear for wanting to invest in real estate is a desire for additional income. Unfortunately most real estate investments, especially residential properties bought for investment, don't generate positive cash flow for quite a while. That means you have to fund losses each year.