Table of Contents

- How much money can a nonprofit have in savings?

- How much surplus can a nonprofit have?

- How much money can a nonprofit have in a bank account?

- Can a 501c3 have too much money?

- The Nonprofit Minute - Cash Reserves

- How much money should I keep in reserves?

- How many bank accounts should a nonprofit have?

- Can a nonprofit have assets?

- What type of bank account is best for nonprofits?

- Can a non profit use a personal bank account?

- What should a nonprofit do with excess funds?

- What should nonprofits do with extra money?

- Does a nonprofit budget have to balance?

- Should nonprofits invest their reserves?

- What are the limitations of a 501c3?

- Can a nonprofit have investments?

- Do nonprofits need a special bank account?

- How does a non profit organization set up a bank account?

- Can I open a nonprofit bank account online?

- What are total assets for a nonprofit?

- What is fund balance in nonprofit?

- What can 501c3 spend money on?

- Can a nonprofit have a debit card?

- How much money can I have in the bank?

- How much is too much liquid cash?

How much money can a nonprofit have in savings?

As a general rule of thumb, nonprofits should set aside at least 3-6 months of operating costs and keep the funds in reserve. Ideally, nonprofits should have up to 2 years' worth of operating expenses in the bank.How much surplus can a nonprofit have?

The Better Business Bureau Wise Giving Alliance, a respected charity watchdog, says that having a surplus of more than three times the annual budget is too much. This means, for example, if your annual budget is $100,000 you should not accumulate a surplus of funds in excess of $300,000.How much money can a nonprofit have in a bank account?

As we stated above, there is no limit to how much money a nonprofit can have in reserve. The key is in the organization's financial management, whether that means reinvesting the reserve back into the nonprofit's mission or ensuring financial security by saving money.Can a 501c3 have too much money?

There's no legal limit on how big your savings can be. Harvard University, at one point, had $34 billion in reserves banked away. The bare minimum for a typical nonprofit is three months; if you've got more than two years' of operating funds socked away, you have too much.The Nonprofit Minute - Cash Reserves

How much money should I keep in reserves?

Most financial experts end up suggesting you need a cash stash equal to six months of expenses: If you need $5,000 to survive every month, save $30,000.How many bank accounts should a nonprofit have?

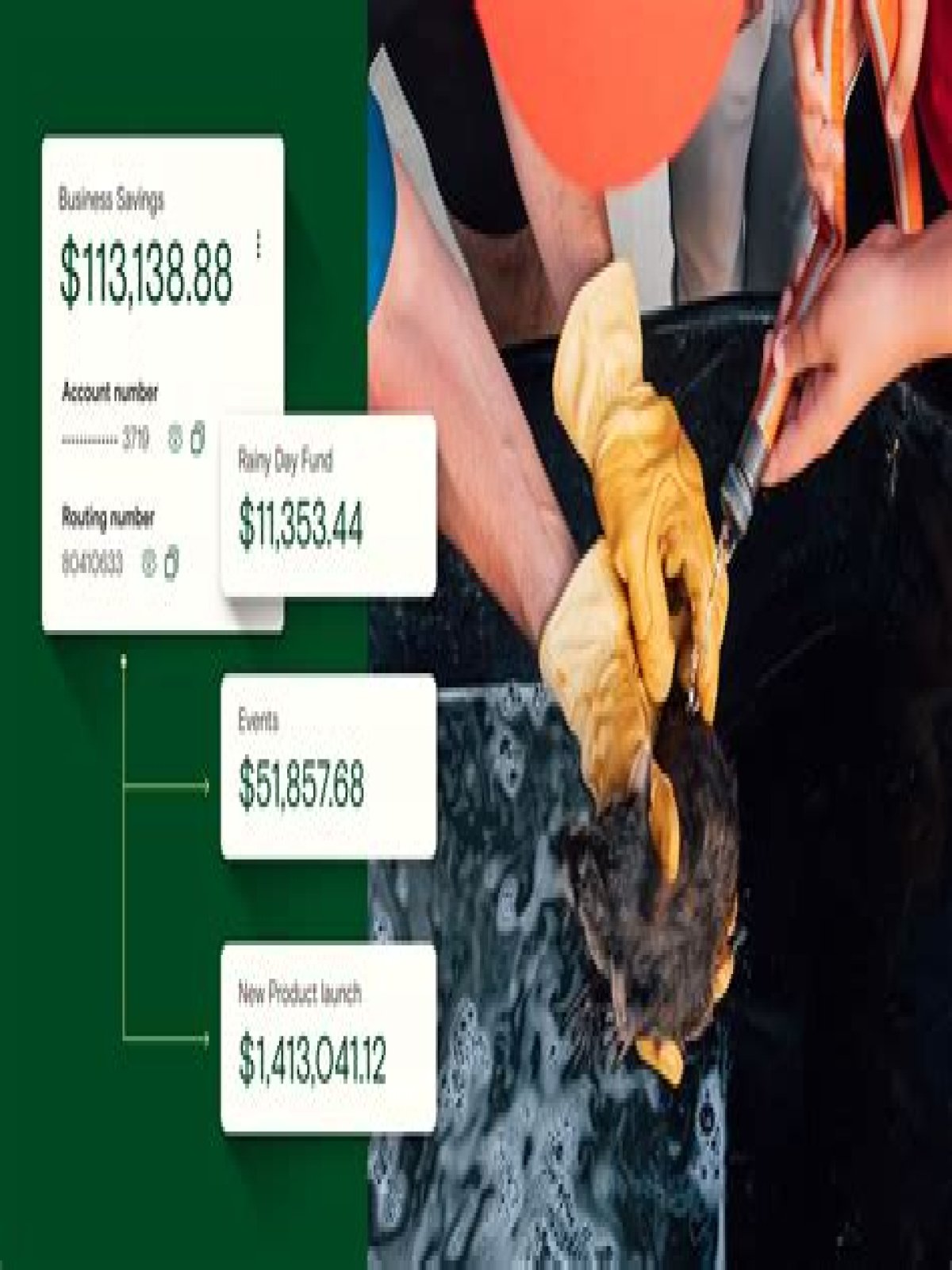

Instead of maintaining multiple accounts, your nonprofit should simplify by going down to one account that utilizes a variety of tools to help keep things running. Programs like QuickBooks help align your finances and track restricted and unrestricted funds.Can a nonprofit have assets?

A nonprofit corporation can buy and sell assets, similar to a profit-oriented entity. The fact that the nonprofit doesn't operate with a profit motive doesn't preclude it from signing a contract, borrowing and purchasing resources deemed operationally essential.What type of bank account is best for nonprofits?

Localized nonprofit organizations may find a better fit with a community bank or credit union. These financial institutions typically offer business banking and lending services, but may be better aligned with your organization's mission than a national bank or for-profit financial institution.Can a non profit use a personal bank account?

Don't use your personal bank account to receive, hold or disburse money for your nonprofit. Make sure all of your nonprofit's transactions go through a dedicated bank account. Ask your bank whether they offer business chequing accounts tailored to nonprofits.What should a nonprofit do with excess funds?

What to Do if Your Nonprofit Has a Surplus or a Deficit

- Create a Reserve Fund – You can always keep excess funds on hand to help cover a future deficit or unforeseen expense.

- Pay Down Debt – Getting ahead on debt will reduce your interest expense and bring you closer to being debt-free.

What should nonprofits do with extra money?

- Incentives for employees. While the surplus cannot go directly back to the board members or faculty, nonprofits can offer an incentive to their staff. ...

- Paying Down Debt. ...

- Direct More Money towards the Mission. ...

- Building a Financial Cushion.