Here's how getting older can save you money:

- Senior discounts.

- Travel deals.

- Tax deductions for seniors.

- Bigger retirement account limits.

- No more early withdrawal penalty.

- Social Security payments.

- Affordable health insurance.

- Senior services.

Table of Contents

- What am I entitled to when I turn 65 in Australia?

- What can I do at age 65?

- Do you get more money when you turn 65?

- Can I get Social Security at 65?

- Social Security at 62 vs 65

- Is it better to collect Social Security at 65 or 66?

- At what age is Social Security no longer taxed?

- What do I need to do before I turn 65?

- Can I retire at 65 and still work full time?

- How much does the average 65 year old get in Social Security?

- What benefits can I claim at 65 UK?

- Do you automatically get a Medicare card when you turn 65?

- How much savings can a pensioner have in the bank Australia?

- Do you pay National Insurance if you work after 65?

- How much will I get if I retire at 65?

- What is the best age to retire at?

- Do I have to notify Social Security when I turn 65?

- What insurance do you need when you turn 65?

- How long before I turn 65 should I apply for Medicare?

- How much Social Security will I get if I make $60000 a year?

- Is it better to take Social Security at 62 or 67?

- Can I work full time at 66 and collect Social Security?

What am I entitled to when I turn 65 in Australia?

- Age Pension. ...

- Carer Allowance. ...

- Carer Payment. ...

- Carer Supplement. ...

- Pensioner Concession Card. ...

- Commonwealth Senior Health Care Card. ...

- Seniors Card (different from State to Territory) ...

- Seniors and Pensioners Tax Offset (SAPTO)

What can I do at age 65?

11 steps to take if you're turning 65 this year

- Make a Social Security plan. ...

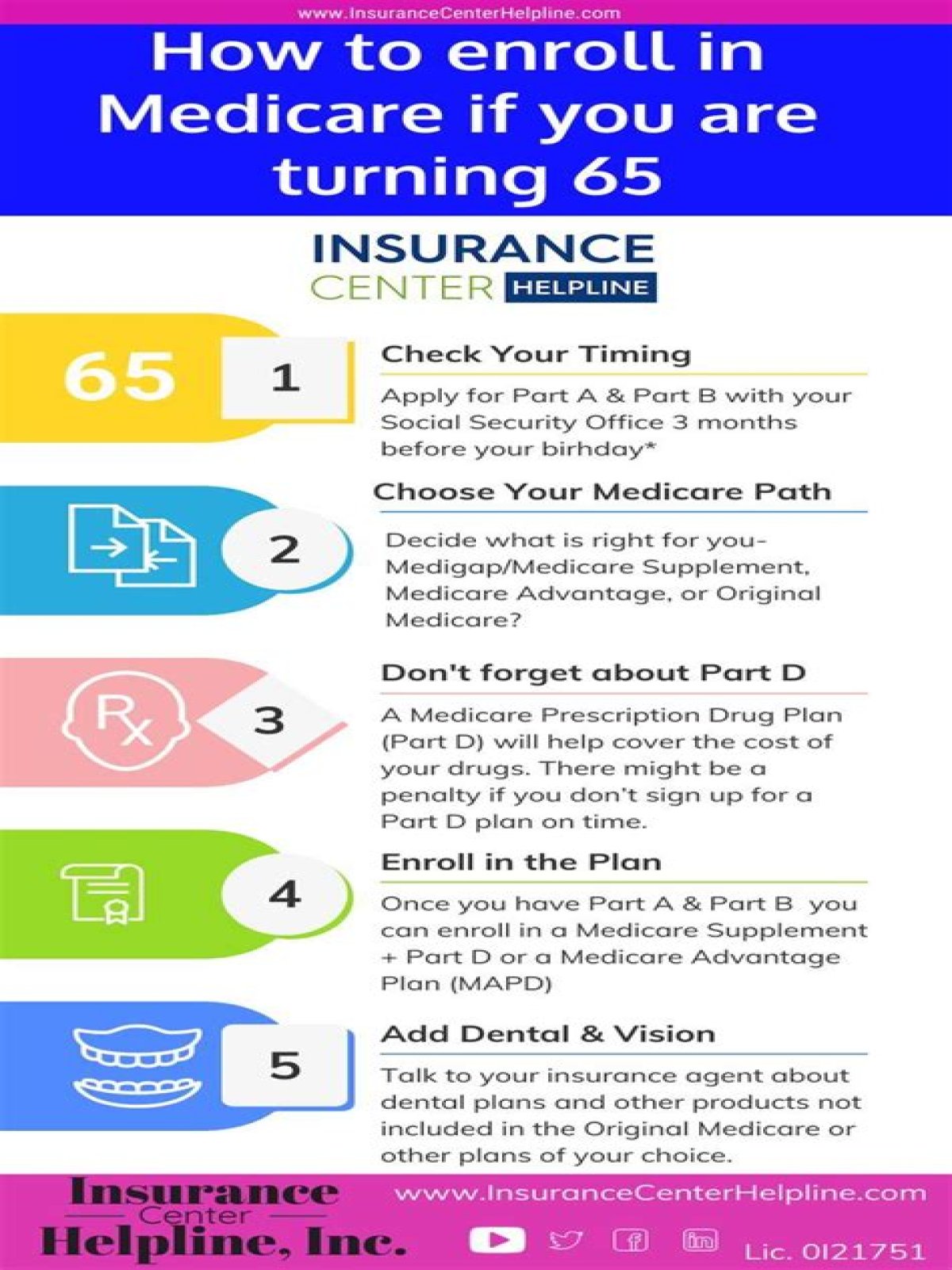

- Get ready for Medicare. ...

- Medigap or Medicare Advantage? ...

- Pick the right Medicare Part D plan. ...

- Consider long-term care insurance. ...

- Start unlocking new travel deals. ...

- Get a property tax break. ...

- Visit the doctor.

Do you get more money when you turn 65?

Starting in the year you turn 65, you qualify for a larger standard deduction when you file your federal income-tax return. The standard deduction for 2020 is generally $12,400 for single filers, $18,650 for head of household, and $24,800 if married filing jointly.Can I get Social Security at 65?

The age for collecting full Social Security retirement benefits will gradually increase from 65 to 67 over a 22-year period beginning in 2000 for those retiring at 62. The earliest a person can start receiving reduced Social Security retirement benefits will remain age 62.Social Security at 62 vs 65

Is it better to collect Social Security at 65 or 66?

Live it up.As you undoubtedly already are well aware, most financial planners recommend that—so long as you can afford to do so—you should wait until age 70 to begin receiving your Social Security benefits. Your monthly payment in such an event will be 32% higher than if you begin receiving benefits at age 66.

At what age is Social Security no longer taxed?

However once you are at full retirement age (between 65 and 67 years old, depending on your year of birth) your Social Security payments can no longer be withheld if, when combined with your other forms of income, they exceed the maximum threshold.What do I need to do before I turn 65?

Turning 65 Soon? Here's a Quick Retirement Checklist

- Prepare for Medicare. ...

- Consider Additional Health Insurance. ...

- Review Your Social Security Benefits Plan. ...

- Plan Ahead for Long-Term Care Costs. ...

- Review Your Retirement Accounts and Investments. ...

- Update Your Estate Planning Documents.

Can I retire at 65 and still work full time?

If you work, and are full retirement age or older, you may keep all of your benefits, no matter how much you earn. If you're younger than full retirement age, there is a limit to how much you can earn and still receive full Social Security benefits.How much does the average 65 year old get in Social Security?

At age 65: $2,993. At age 66: $3,240. At age 70: $4,194.What benefits can I claim at 65 UK?

- Extra pension payments.

- Money off your council tax.

- Help towards hospital travel costs.

- Free Strictly Come Dancing.

- Lost pensions or bank accounts.

- Free eye tests.

- Free travel.