Table of Contents

- Who must issue 1099-MISC?

- What are the rules for issuing 1099s?

- Do I need to issue a 1099-MISC to a contractor?

- Who gets a 1099-NEC and who gets a 1099-MISC?

- All you need to know about Form 1099 Misc

- What qualifies as a 1099 vendor?

- Do I use 1099-MISC or NEC?

- Do I need to send a 1099 to an LLC?

- Do I need to send 1099 to subcontractors?

- Can an individual issue a 1099-MISC?

- Does a professional corporation get a 1099?

- Who do I need to send a 1099 to 2021?

- Does an LLC S Corp get a 1099?

- What happens if I don't 1099 a contractor?

- Does an S Corp get a 1099-NEC?

- Do I have to send a 1099 to every vendor?

- Do you need to send a 1099 to an individual or sole proprietor?

- Do individual sole proprietor or single member LLC get 1099?

- Can I use a 1099-MISC for an independent contractor?

- Who Receives 1099-NEC?

- Do I need to send my accountant a 1099?

- How do you know if a vendor is a 1099 vendor?

- What is not a 1099 vendor?

- Does an C corp get a 1099?

- Who gets a 1099-MISC form 2021?

Who must issue 1099-MISC?

Businesses are required to issue a 1099 form to a taxpayer (other than a corporation) who has received at least $600 or more in non-employment income during the tax year. For example, a taxpayer might receive a 1099 form if they received dividends, which are cash payments paid to investors for owning a company's stock.What are the rules for issuing 1099s?

1099-MISC.The “general rule” is that business owners must issue a Form 1099-NEC to each person to whom they have paid at least $600 in rents, services (including parts and materials), prizes and awards, or other income payments. You don't need to issue 1099s for payment made for personal purposes.

Do I need to issue a 1099-MISC to a contractor?

Keep in mind that if you're an independent contractor, you still need to report all your income. Even if you did less than $600 of work for a client and never received a 1099. If you did pay a contractor more than $600 for services, you need to file a 1099.Who gets a 1099-NEC and who gets a 1099-MISC?

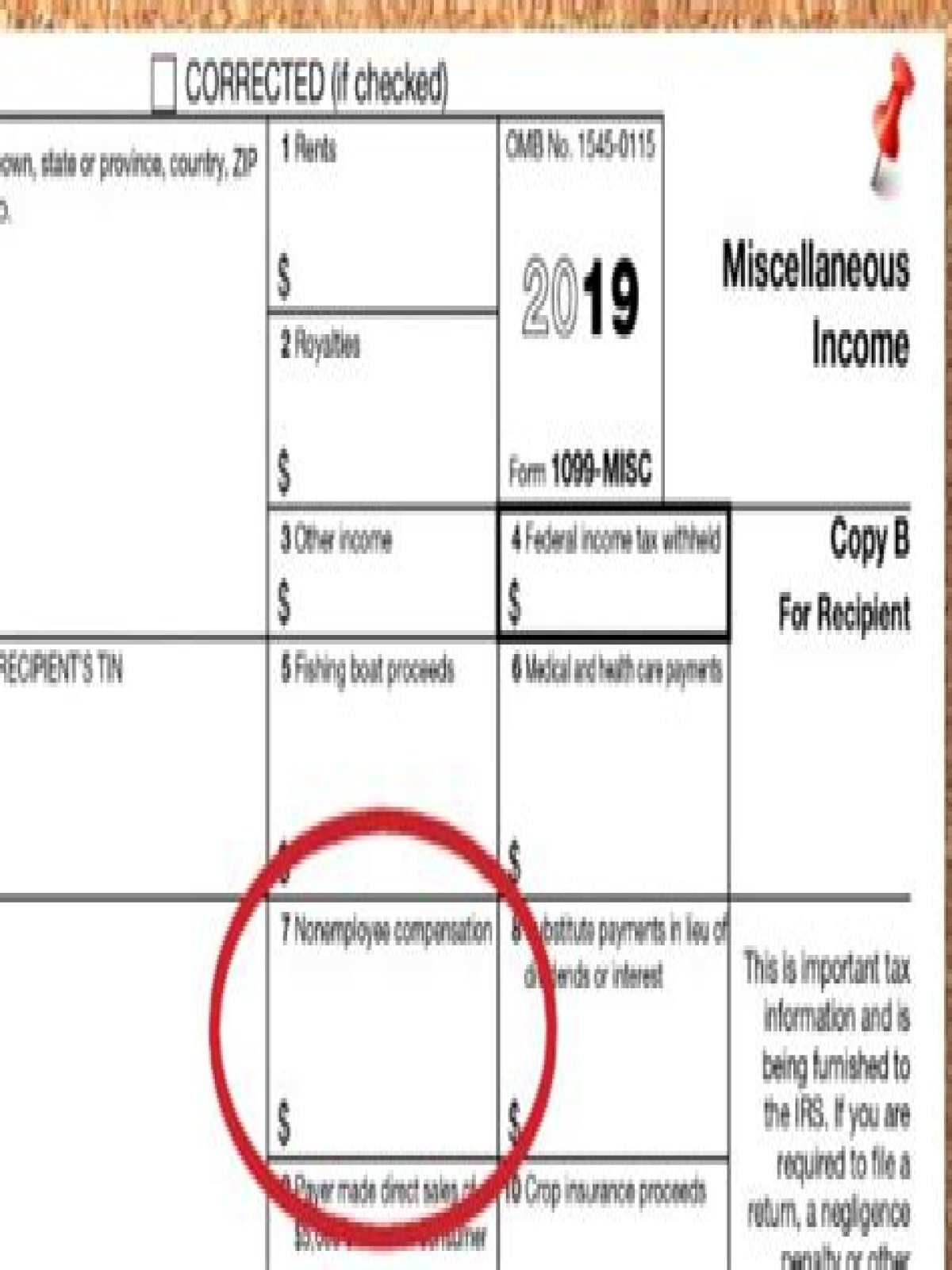

A business will only use a Form 1099-NEC if it is reporting nonemployee compensation. If a business needs to report other income, such as rents, royalties, prizes, or awards paid to third parties, it will use Form 1099-MISC.All you need to know about Form 1099 Misc

What qualifies as a 1099 vendor?

A 1099 vendor is a person or business who performs work for you but is not an employee of your organization. Vendors that you pay more than $600 to per fiscal year must receive an IRS Form 1099 from you.Do I use 1099-MISC or NEC?

Beginning with the 2020 tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor.Do I need to send a 1099 to an LLC?

If your business pays an LLC more than $600 a year for rent or services, you'll need to issue a 1099 Form to the LLC and file it with the Internal Revenue Service. Issuing a 1099 isn't difficult, but it's an important part of your business's accounting and tax preparation plan.Do I need to send 1099 to subcontractors?

If you paid someone who is not your employee, such as a subcontractor, attorney or accountant $600 or more for services provided during the year, a Form 1099-NEC needs to be completed, and a copy of 1099-NEC must be provided to the independent contractor by January 31 of the year following payment.Can an individual issue a 1099-MISC?

Individuals may file a 1099-MISC to report money they paid to another individual for rent, royalties or prizes. An individual may use 1099-MISC if he owns or operates a fishing boat and made payments to crew members.Does a professional corporation get a 1099?

Form 1099s must be sent to sole proprietors, S corporations, LLCs and partnerships. As a general rule, a business doesn't need to issue a 1099 to a corporation or an LLC organized as a corporation. There are a few exceptions to that rule, however.Who do I need to send a 1099 to 2021?

Generally, you're required to file a Form 1099-NEC if you meet the following conditions:

- You paid someone who's not your employee.

- You paid for services in the course of your trade or business.

- You paid an individual, partnership, estate, or corporation (in some cases)

- You paid at least $600 to the payee during the year.