Likewise, are installment loans bad?

While installment loans are common, not all have good terms. Good credit can make it easier for borrowers to qualify for a loan and possibly get a better interest rate. But when you have lower credit scores, you may end up with an installment loan with a higher interest rate and expensive fees.

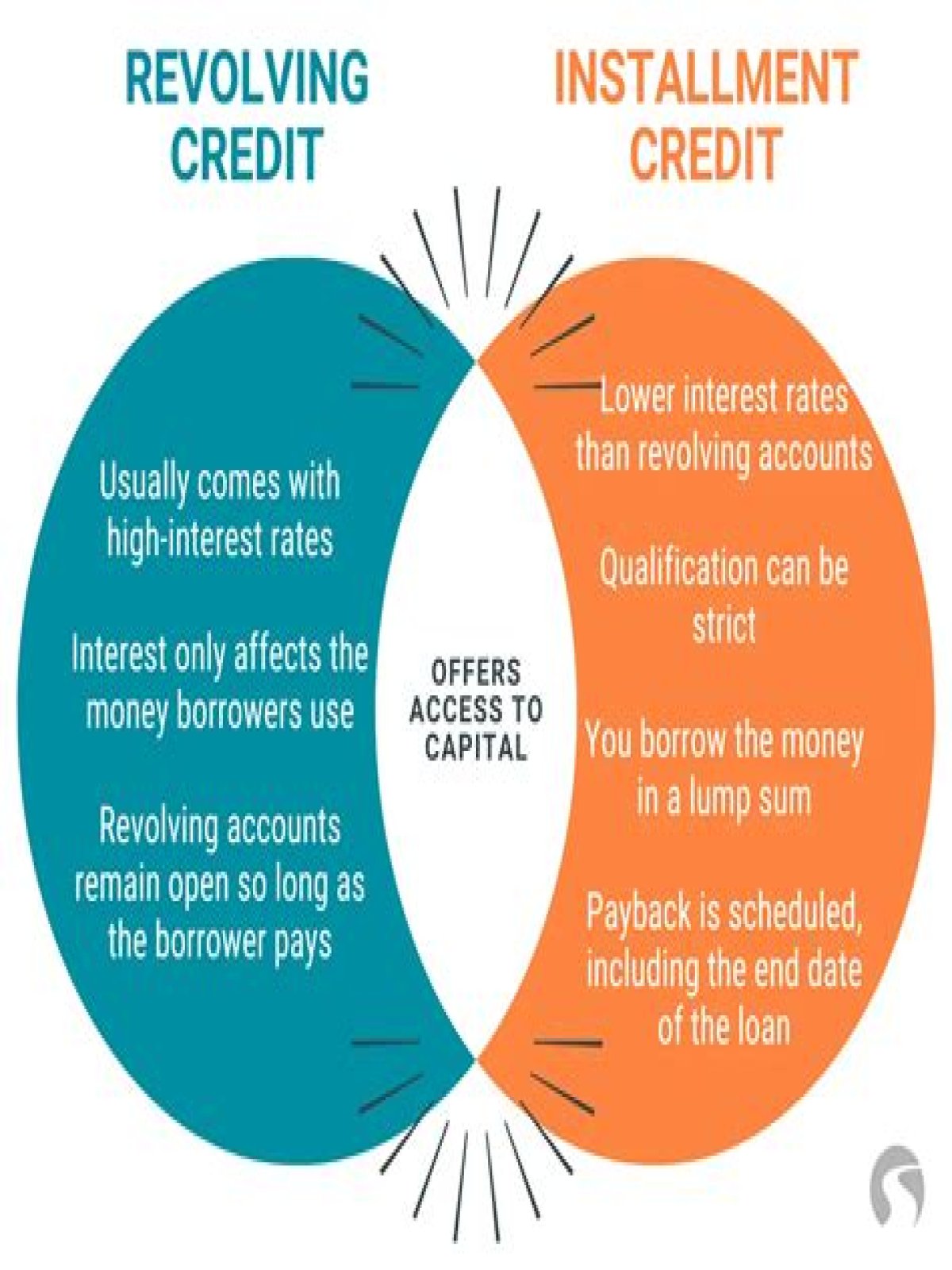

Also, what qualifies as an installment loan? An installment loan is a loan that is repaid over time with a set number of scheduled payments; normally at least two payments are made towards the loan. The term of loan may be as little as a few months and as long as 30 years. A mortgage, for example, is a type of installment loan.

Similarly, it is asked, which is better a personal loan or mortgage?

There are two major differences between personal loans and mortgages. A personal loan is unsecured, whereas a mortgage uses your house as collateral — if you default on a mortgage, you could lose your home. A personal loan is also for a much smaller amount, which makes it difficult to buy a house with one.

What is better mortgage or home equity loan?

The difference between a home equity loan and a traditional mortgage is that you take out a home equity loan after you have equity in the property, while you get a mortgage to purchase the property. Your loan-to-value (LTV) ratio is used by lenders to figure out how much money you can borrow.

How long does an installment loan stay on your credit?

Do loans increase credit score?

What is an example of installment credit?

How can I get out of an installment loan?

- Set Up a Sooner Payoff Date. Make a contract with yourself.

- Apply Unexpected Money to Your Loan.

- Round Your Payments Up.

- Bring in Extra Income.

Does paying off an installment loan increase credit score?

Do they check your credit for an installment loan?

Can I get an installment loan with no credit?

What happens when you refinance an installment loan?

Can I get a personal loan to pay off mortgage?

What is a good rate for a personal loan?

Which bank has lowest interest rate on personal loan?

- American Express: 6.90%+ APR.

- Barclays: 5.74%+ APR.

- Discover: 6.99%+ APR.

- Fifth Third Bank: 6.99%+ APR.

- HSBC: 5.99%+ APR.

- PNC: 5.99%+ APR.

- Santander Bank: 6.99%+ APR.

- TD Bank: 6.99%+ APR.