Also question is, do I need to issue a 1098?

No, you do not need to issue a Form 1098 as an individual holding a mortgage. However, you do need to give the buyer a statement showing the total mortgage interest you received from them, your name, address, and Social Security number.

Beside above, how do I get a 1098 form? To order these instructions and additional forms, go to Caution: Because paper forms are scanned during processing, you cannot file Forms 1096, 1097, 1098, 1099, 3921, 3922, or 5498 that you print from the IRS website.

Likewise, people ask, who Must File 1098?

Form 1098 is used to report mortgage interest paid for the year. This form must be issued by lenders when a homeowner's mortgage interest paid is $600 or more. You need Form 1098 when filing taxes if you plan to claim a mortgage interest deduction.

What do I do if I didn't get a 1098?

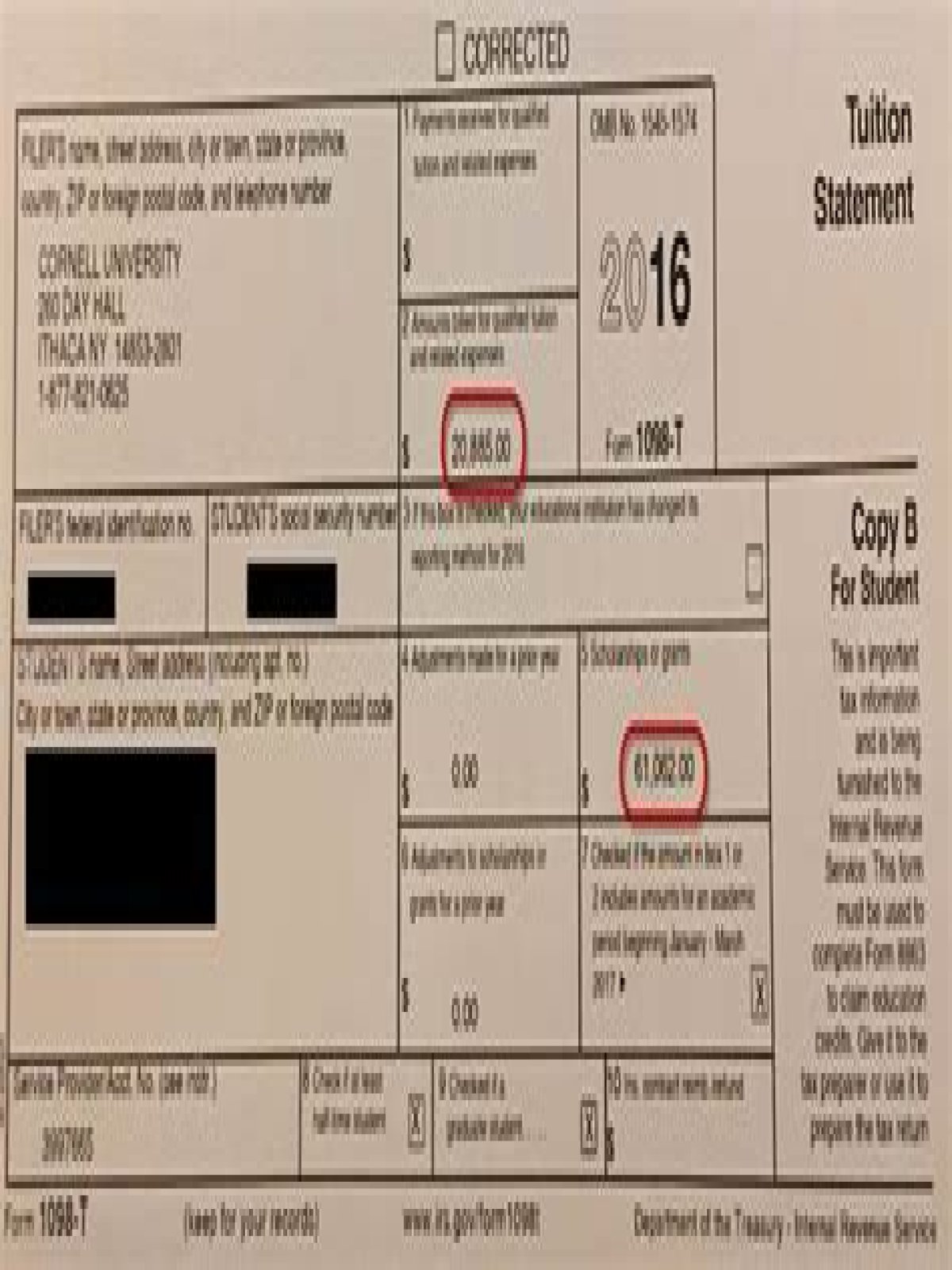

If you don't receive a Form 1098-T by Jan 31st, you can still enter your school expenses without a Form 1098-T. The IRS does not explicitly require a Form 1098-T in order to claim any education-related credits. To enter the expenses, simply proceed with the education section of TurboTax as normal.