Consequently, can an investment advisor receive 12b 1 fees?

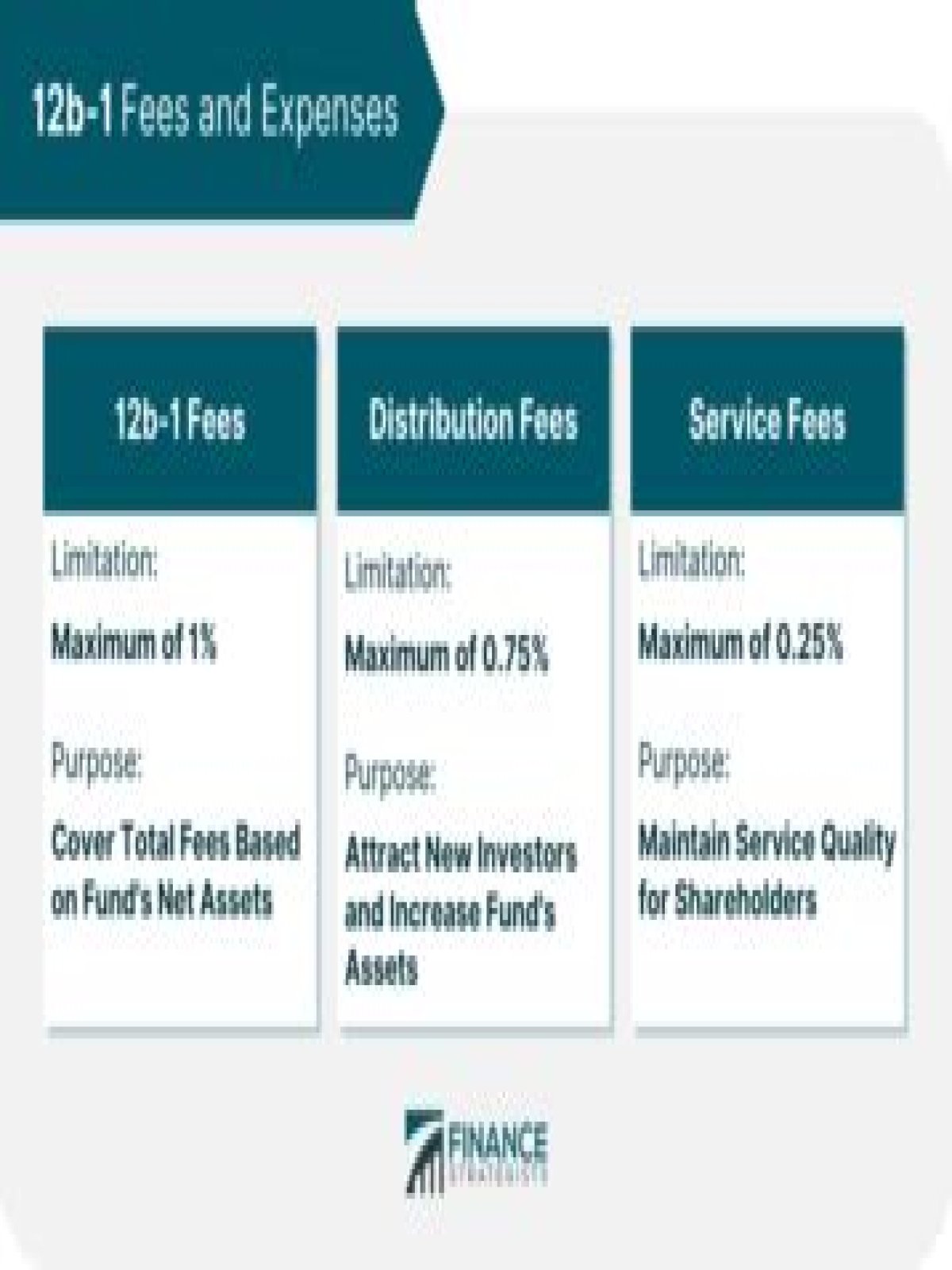

Mutual fund investors pay 12b-1 fees to cover the marketing, promotion and service expenses of their investments. The marketing and distribution fee is a commission investors pay to financial advisors and brokers, while the service fee clients pay to investment managers who provide advice and customer service.

Also, what are 12b 1 fees used for? 12b-1 fees are marketing and distribution expenses that fund shops charge investors. These fees are used to pay for advertising and marketing efforts, including commissions paid to financial advisors for recommending the shop's funds to clients.

Similarly, you may ask, do Vanguard clients pay 12b 1 fees or not?

In contrast to its competitors, Vanguard is one of a select few fund companies known for refusing to charge clients revenue sharing or 12b-1 fees on any of its own funds. Asset manager Dimensional Fund Advisors says it also does not charge clients these fees.

What is the maximum 12 b1 fee a no load mutual fund can charge?

12b-1 fees can be as large as 1% of an investor's balance per year, although they are actually deducted from accounts daily. Even a no-load fund can charge up to 0.25%.

How often are 12b 1 fees paid?

How are 12b 1 fees paid?

Do no load funds have 12b 1 fees?

Do Class A shares have 12b 1 fees?

What is a 12b 1 plan?

What are distribution fees?

What is a 12b?

What are sub TA fees?

Is Vanguard brokerage account free?

Is Vanguard or Charles Schwab better?

How do you avoid Vanguard fees?

Does Vanguard have hidden fees?

How much money do you need to start a Vanguard account?

Does Vanguard charge transaction fees?

Is Vanguard good for Roth IRA?

What is Vanguard expense ratio?

What is the best Vanguard?

- Vanguard Total Stock Market Index (VTSMX)

- Vanguard 500 Index (VFINX)

- Vanguard Total Bond Market Index (VBMFX)

- Vanguard Total International Stock Market Index (VGTSX)

- Vanguard Growth Index (VIGRX)

- Vanguard Balanced Index (VBINX)

- Vanguard Wellesley Income (VWINX)