- DECIDE ON A BUSINESS NAME.

- FILE A FICTITIOUS BUSINESS NAME (FBN) FOR YOUR LOS ANGELES BUSINESS.

- DETERMINE YOUR BUSINESS ADDRESS.

- SELECT A BUSINESS ENTITY FOR YOUR BUSINESS.

- REGISTER YOUR BUSINESS WITH THE SECRETARY OF STATE.

- DRAFT YOUR OPERATING AGREEMENT, PARTNERSHIP AGREEMENT OR BYLAWS.

Likewise, how do I set up an LLC in Los Angeles?

Starting an LLC in California is Easy

- STEP 1: Name Your California LLC.

- STEP 2: Choose a Registered Agent in California.

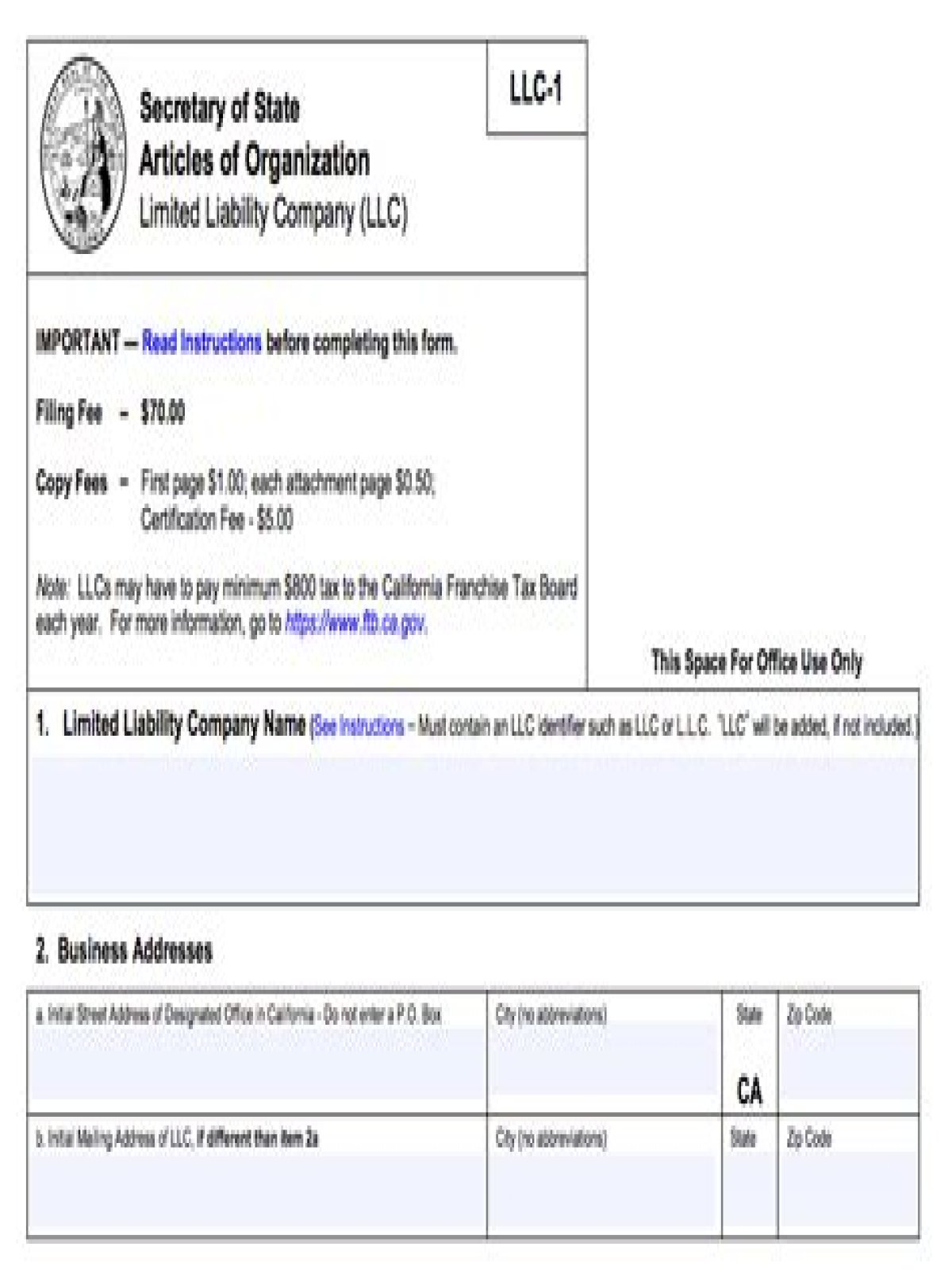

- STEP 3: File the California LLC Articles of Organization.

- STEP 4: File the Initial Statement of Information.

- STEP 5: Create a California LLC Operating Agreement.

- STEP 6: Get an EIN for your California LLC.

Beside above, how do I register an LLC in California? How to Form an LLC in California

- Choose a Name for Your California LLC.

- File Articles of Organization with the Secretary of State.

- Choose a Registered Agent.

- Decide on Member vs.

- Prepare an Operating Agreement.

- File a Statement of Information With the Secretary of State.

- Pay Your California State Tax Obligations.

Subsequently, one may also ask, how much does it cost to set up an LLC in California?

An LLC is formed in California by filing Articles of Organization with the California Secretary of State and paying a $70 filing fee. Most businesses must also pay an $800 franchise tax. In addition, within 90 days of filing the Articles of Organization, the LLC must file a Statement of Information and pay a $20 fee.

Do you have to pay the $800 California LLC fee the first year?

All LLCs in California must file Form 3522 and pay the $800 Annual Franchise Tax every year, regardless of revenue or activity. Said another way, there's no way to avoid this fee. The first $800 payment is due the “15th day of the 4th month” after your LLC is approved.

Why do I need a business license?

Should I form an LLC in California?

You can download Form 568 here:

| LLC estimated income | Fee |

|---|---|

| $5,000,000 or more | $11,790 |