Accordingly, how do I file Oregon OQ?

Choose a quarterly report filing method:

- Oregon Payroll Reporting System (OPRS) electronic filing.

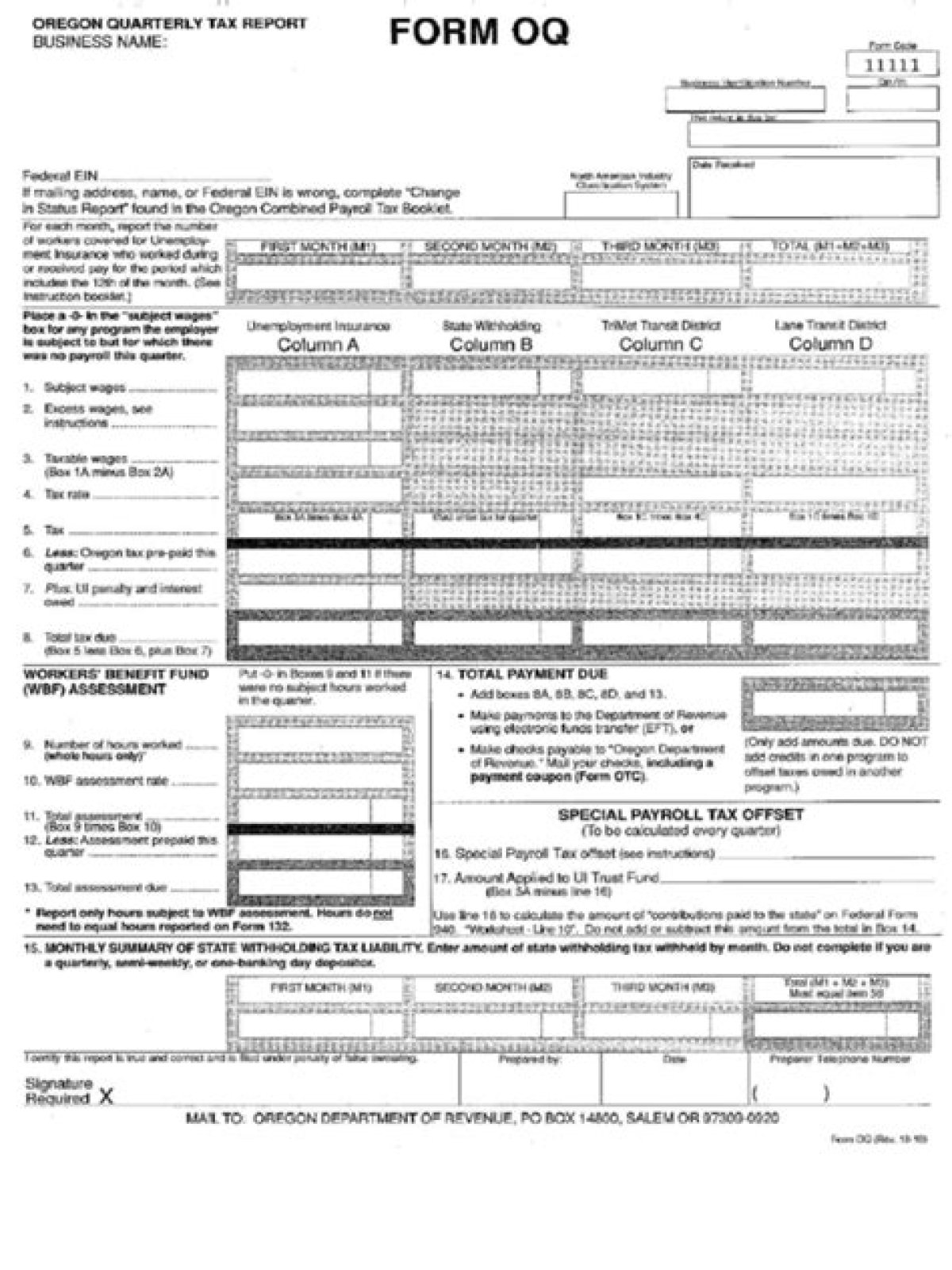

- Combined Payroll Tax Reports Form OQ.

- Interactive voice response system, call (503) 378-3981. Use only to report quarters with no payroll or no hours worked.

Also, what is Oregon withholding? HB 2119 (2019) requires employers to withhold income tax at a rate of eight (8) percent of employee wages if the employee hasn't provided a withholding statement or exception certificate. Continue withholding at the eight percent rate until the employee submits a withholding statement and exemption certificate.

Subsequently, one may also ask, what is Oregon form OA?

Overview. The Oregon Annual reports and computes the tax due for Unemployment Insurance, State Withholding, and the Workers' Benefit Fund assessment. Some information on this screen is pre-filled or unavailable for editing based on information entered on previous screens.

What are Oregon payroll taxes?

Taxable minimum rate:

Where do I mail OQ forms?

| Form OQ | Oregon Department of Revenue PO Box 14800, Salem, OR 97309-0920 |

|---|---|

| Form OR-OTC | Oregon Department of Revenue PO Box 14800, Salem, OR 97309-0920 |

| Form 132 | Oregon Department of Revenue PO Box 14800, Salem, OR 97309-0920 |

| Schedule B | Oregon Department of Revenue PO Box 14800, Salem, OR 97309-0920 |