Also, what are bank debt securities?

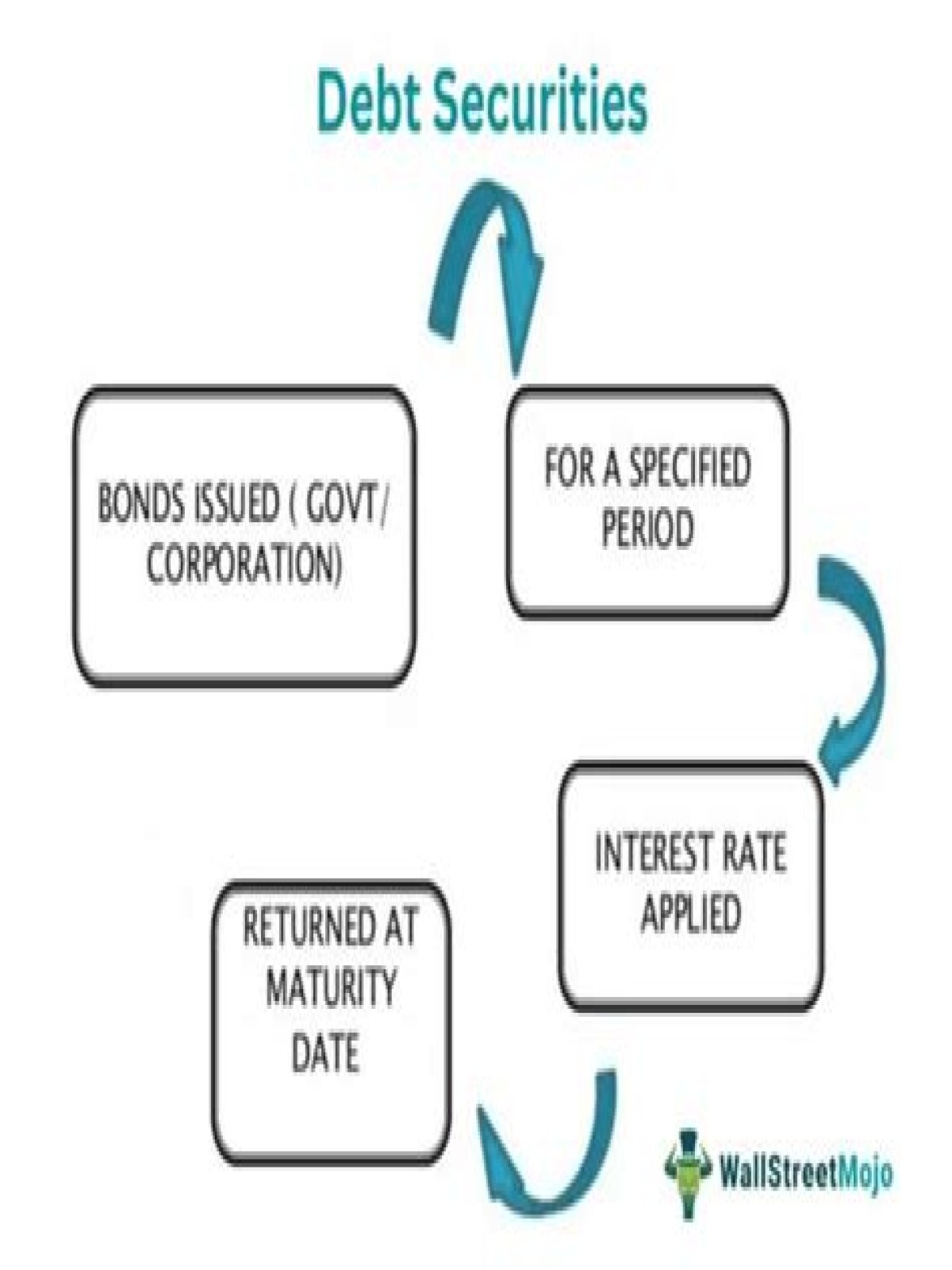

Debt security refers to a debt instrument, such as a government bond, corporate bond, certificate of deposit (CD), municipal bond, or preferred stock, that can be bought or sold between two parties and has basic terms defined, such as notional amount (amount borrowed), interest rate, and maturity and renewal date.

Likewise, is a debt security a loan? Loans are a type of debt in which a lender lends the money and a borrower borrows the money. A specific time limit is set for the repayment of the debt money or the principal amount which has been borrowed by the borrower from the lender; a bond is a type of loan also called a debt security.

Herein, what exactly are securities?

A simple definition of a security is any proof of ownership or debt that has been assigned a value and may be sold. For the holder, a security represents an investment as an owner, creditor or rights to ownership on which the person hopes to gain profit. Examples are stocks, bonds and options.

What are corporate debt securities?

A corporate bond is an investment in debt that is issued by a company and sold to an investor. The company gets the cash it needs and in return the investor is paid a pre-established number of interest payments. In some cases, the company's physical assets may be used as collateral.